Implications Of The Fed's May 3rd Rate Decision

The stock sell-off that took place immediately after the Fed's rate decision reflected fears about bank profitability, commercial real estate, and an economic slowdown. But the news isn't all bad.

Summary

The Fed’s May 3rd 25 basis point rate hike was largely anticipated.

Jay Powell's post-decision press conference was relatively dovish.

The sell-off in stocks and the drop in rates that took place immediately after the Fed's decision reflect fears about bank profitability, commercial real estate, and an impending economic slowdown.

Should this slowdown materialize, it will serve to undo much of the damage that the Fed's tightening cycle has caused in a self-correcting feedback loop.

Beneficiaries of this will be firms that are not credit-sensitive and that do not have real estate exposure. Technology firms come to mind.

FOMC Day

May 3rd saw the much anticipated release of the Federal Open Market Committee's (FOMC) interest rate decision. As expected, the Fed raised the federal funds target rate by 25 basis points to a range of 5-5.25%. The post-decision news conference with Federal Reserve Chair Jay Powell was relatively dovish, with Powell noting that the current policy statement is missing the language that the FOMC "anticipates that some additional policy firming may be appropriate." Powell emphasized that this is a noteworthy development.

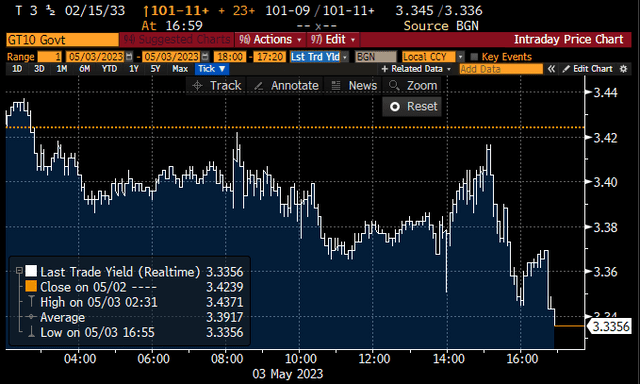

Despite the dovish tone of Powell's remarks and the fact that the Fed's 25 basis point rate hike was largely consistent with investor expectations, the market nevertheless reacted strongly after the announcement. The policy decision came out at 2pm at which point interest rates first increased — though that move was short-lived — and then fell with the 10-year Treasury yields ending the day about 9 basis points lower.

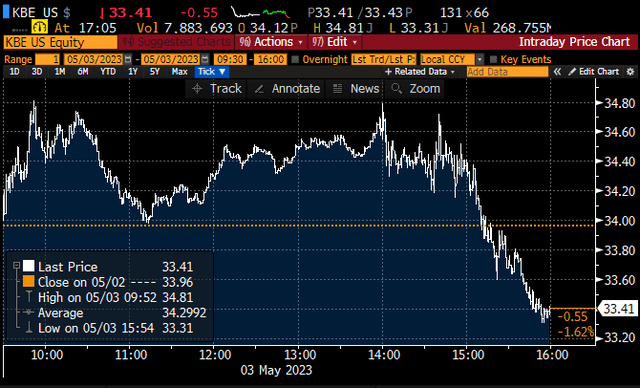

Stocks had been trading in the black on the day, but took a meaningful nosedive after 2pm, with the KBE bank ETF finishing the day down 1.6%. More on this momentarily.

Inflation breakevens, after experiencing some volatility around the 2pm announcement, finished the day largely unchanged. The 10-year breakeven closed at 2.19%, basically flat to the prior day’s level, suggesting that market participants interpreted the Fed’s decision as unsurprising and as consistent with the Fed's 2% long-term inflation target.

The macro backdrop

Most surprising about the day’s events was not the Fed's statement, but the market's reaction to that statement. The Fed signaled it was done hiking for the time being, and that it had entered data-watching mode. What data will the Fed be watching, and what should investors pay attention to in the coming weeks and months?

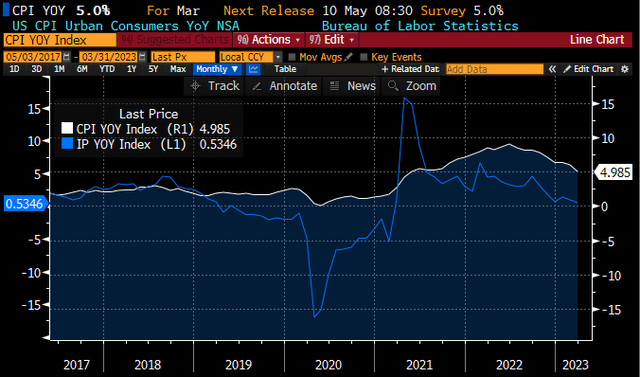

As has been the case for most of the last 18 months, the Fed is keeping an eye on economic growth and inflation. Headline inflation, after peaking close to 10% in mid-2022, is now sub-5% and apparently heading lower. Industrial production, after its large year-over-year post-COVID increase in 2021, is also headed lower. Both series are trending in a direction that policymakers concerned about inflation want to see.

What is probably more concerning, from a purely inflation point of view, is the extraordinarily strong labor market in the U.S. After touching nearly 15% during the 2020 pandemic shutdown, the unemployment rate is now at 3.4%, and other measures of the job market are equally strong. If there is one prime focus of the Fed's inflation fears, it is the strong labor market.

Energy remains a bit of a wildcard, as OPEC and many Wall Street analysts are decidedly on the side of tighter supply. And yet oil prices keep going lower. Surely this is helping the inflation story, but the reasons for potential oil price increases — an unexpected development in the Ukraine conflict, stronger China growth post its COVID reopening, depletion of the strategic petroleum reserve in the U.S. — all remain in place. A spike in energy prices remains a risk to the Fed's inflation target and might lead to tighter than expected policy, but this is not the base case outcome.

Banks and markets

The elephant in the room is clearly the impact that the Fed's policy decisions are having on the asset and liability side of the U.S. banking system. With recent failures of Silicon Valley Bank and last week's seizure of First Republic Bank, investor attention is firmly planted on the asset and liability side of bank — especially regional bank — balance sheets. Tightening policy is impacting banks in two ways:

Banks are now sitting on large unrealized losses on the asset side of their balance sheet — whether in Treasury positions or in fixed-rate mortgages — which bank runs or fears thereof are forcing bank to monetize, i.e., as deposits flee (or as they anticipate deposit flight), banks need to sell their liquid held-to-maturity securities and thus monetize the losses to meet redemptions.

With competing safe investment options, like T-bills or money market funds, paying rates between 4.5-5%, banks need to pay more on deposits to prevent depositors outflows. If they don't do this, then deposits leave, forcing banks to reduce the asset side of the balance sheet. In either case, profitability suffers. May 3rd’s additional 25 basis point hike is not helping matters, as banks will need to pay yet more to keep their depositors from jumping to more attractive, safe options.

The earnings story is the most benign interpretation of this year's large sell-off in bank stocks. The less benign interpretation is that the credit contraction loop set off by Fed tightening will ultimately impair credit quality on banks' balance sheets.

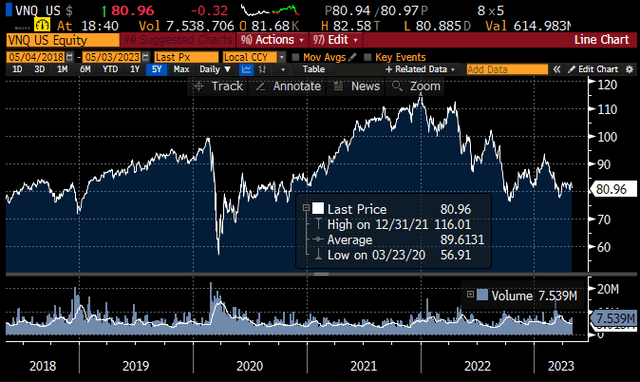

The likeliest channel here is through commercial real estate. The post-pandemic work-from-home regime has already had a very negative impact the office segment of the commercial real estate (CRE) market. Combine this with the fact that regional banks — the ones most under pressure from depositor flight — provide 70% of CRE financing (by some measures), and the natural takeaway is that pressure in the CRE space will continue, despite considerably lower valuations than at the start of the year.

With weak fundamentals already in place and with tightening credit conditions, there are now fears of defaults in the CRE space, which will then lead to realized losses on bank balance sheets, which will lead to further credit contraction. Of course, all of this will help the Fed's inflation battle, which Powell acknowledged by noting that all these issues are "resulting in even tighter credit conditions for households and businesses."

Are there any bright spots?

Fortunately, there is a bull case out there as well. An important leg of the bull case is that, unlike in 2008-2009, the current banking tremor is self-correcting. In 2008-2009, as mortgage defaults dented bank balance sheets, banks tightened credit creation, which slowed economic growth, which led to further defaults and further credit contraction. The 2008-2009 financial crisis was characterized by a self-reinforcing negative feedback cycle.

Today's story is exactly the opposite. As credit contraction caused by the Fed's tightening cycle slows economic growth, inflation will naturally be brought under control, the Fed will start to ease (as the deeply inverted 2s-10s curve is suggesting), rates will fall, and bond prices will rise. This will naturally re-inflate the asset side of bank balance sheets and will ease the cost of bank deposits, thus plugging mark-to-market holes and restoring profitability. So rather than having a bad feedback loop, we are now in a self-correcting feedback loop. This bodes well for financial stability.

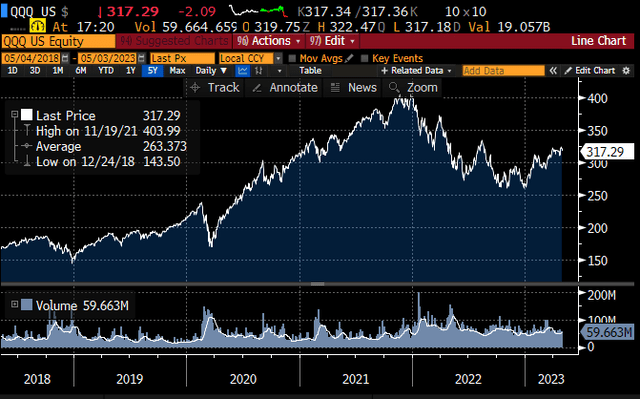

Furthermore, despite incessant media attention, the economy is more than just banks and commercial real estate. For example, there was recently a great news story about a promising Alzheimer’s drug trial from Eli Lilly. Indeed, the healthcare ETF IYH has been very resilient. Another sector with a great earnings story is technology. Much (both good and bad) has been written about the latest advances in artificial intelligence (AI), but the fact that these technologies are for real and that they will greatly boost productivity appears clear. This has not been lost on the market, as QQQ has had a massive rally so far in 2023.

Even though tech stocks may not look cheap on a price-to-earnings basis, it must be kept in mind that they benefit from two major trends. First, their earnings are likely to be positively impacted by the aforementioned AI developments. Second, these stocks benefit disproportionately from falling interest rates. The reason for this effect is that much of tech earnings is anticipated to take place in the future, and these future cash flows are particularly sensitive to the level of interest rates. This is why tech stocks fell so much in 2022, and why they stand to benefit should the self-reinforcing stabilization loop (credit contraction leading to slower growth leading to lower rates) materialize.

To summarize

The May 3rd Fed action was largely anticipated. The market's surprising reaction reflects continued fears of a negative impact of higher rates on banks and on commercial real estate, and of an impending slowdown in economic growth and inflation. Importantly, should this happen, it will serve to undo many of the problems that were created by the Fed's tightening cycle in the first place. High up on the list of beneficiaries will be companies that are not credit or real estate sensitive, and especially companies with strong earnings prospects and long-dated cash flow. Tech comes to mind.

As always, investors should carefully consider their own risk tolerance and liquidity needs when investing. If you would like to receive more analysis like this in the future, please subscribe.